Shopify, the dominant e-commerce platform, hosts a vast number of active stores, capturing a significant portion of the online retail market. With its user-friendly interface and ability to scale for businesses of all sizes, Shopify continues to be a popular choice for merchants worldwide.

When it comes to managing finances, taxes play a crucial role for businesses to stay compliant and financially healthy. In the dynamic landscape of e-commerce, having the right tax apps integrated into your Shopify store can streamline operations, alleviate tax-related stress, and ensure accurate reporting for the year 2024.

With a plethora of tax apps available in the Shopify App Store, selecting the best ones for your specific business needs is vital. The tax apps you choose can have a substantial impact on your store's financial management, compliance, and overall success in the upcoming year.

Whether you're just starting your e-commerce journey or looking to optimize tax processes for an established Shopify store, the right tax apps can make a significant difference in your business operations. Explore our top recommendations for the best tax apps for Shopify in 2024 to make informed decisions and maximize your financial efficiency.

From $49/month. Free trial available.

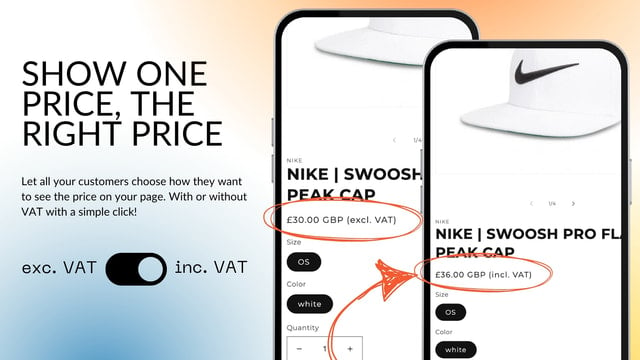

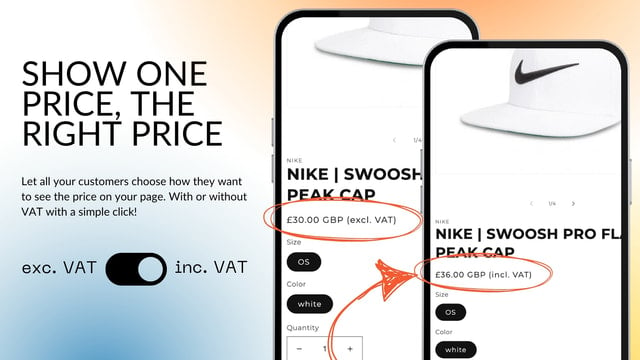

Facilitate a seamless shopping experience for customers with the ability to view prices according to their preferences, all through a single-click toggle feature. This functionality allows users to effortlessly switch between VAT-inclusive and exclusive pricing based on their status, whether they are B2B or B2C clients.

Support for multiple VAT rates ensures compliance with various regulations and caters to diverse market needs. The tool's integration is user-friendly, with installation handled by the team to guarantee everything operates smoothly on a duplicate theme before launch.

Whether displaying prices with or without VAT, merchants can easily align their pricing strategies with customer expectations while simplifying tax management. This adaptable solution streamlines operations, giving businesses more control over pricing presentation and enhancing the overall shopping journey. Embrace flexible pricing adjustments tailored to your unique selling landscape.

$4.99/month. Free trial available.

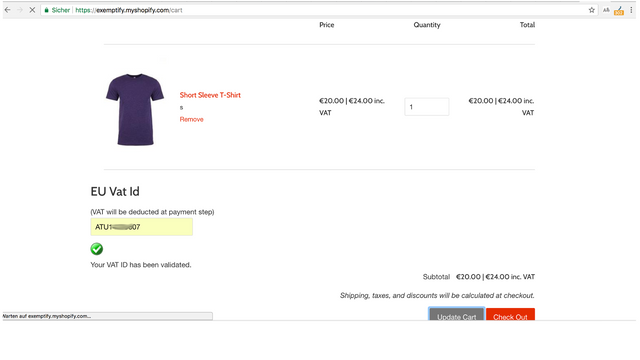

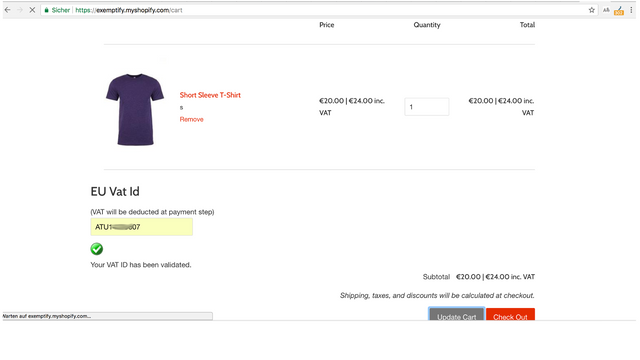

Streamline the purchasing experience for your European customers by validating EU VAT IDs in real-time. This functionality ensures that only eligible customers receive tax exemption status, simplifying compliance with the latest EU distance sales regulations.

Enjoy seamless integration for Shopify Plus stores by accommodating VAT ID validation directly within the checkout process. This allows for an efficient transaction flow while automatically applying the correct local tax rates based on customer location. Clear pricing visibility at checkout enhances the shopping experience, as customers know their final costs upfront.

The ability to add VAT IDs to existing customer profiles within the Shopify Admin facilitates ongoing customer relationship management. Tailored for international sales, this solution not only eases tax compliance but also promotes transparency, allowing merchants to focus on growth without the hassle of complex tax regulations.

From $7/month. Free trial available.

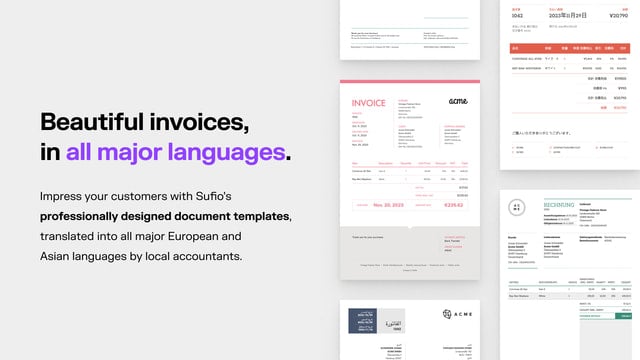

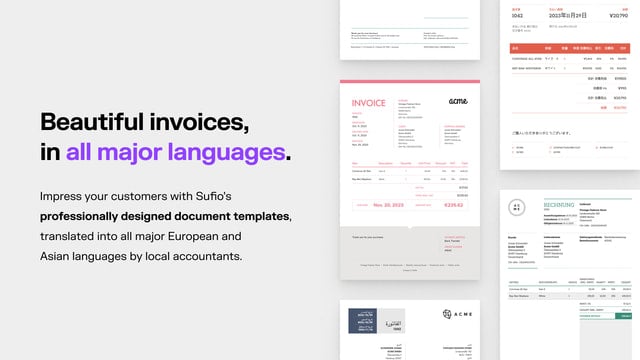

Streamline financial documentation with a solution that simplifies the creation and management of invoices, credit notes, and more. With easy-to-use workflows, tailor your document generation to suit the intricacies of your business operations.

Each invoice template is professionally designed and tailored for customization, allowing for a brand-centric presentation that leaves a lasting impression on customers. Compliance with global regulations for both B2C and B2B transactions is assured, as each document is validated by certified accountants.

Support is readily available to assist with the proper configuration of invoices and tax settings, ensuring hassle-free operations. Foster trust with clients through polished professionalism, making financial transactions not just a necessity but an experience.

From $4.99/month. Free trial available.

Free plan available. Free trial available.

Streamline financial management by synchronizing Shopify data with Xero, Sage Intacct, and QuickBooks platforms effortlessly. This tool automates the integration of key elements such as inventory levels, transaction fees, taxes, discounts, gift cards, shipping fees, and customer information, significantly reducing manual data entry errors.

Experience seamless reconciliation and the ability to generate historical reports with a multi-currency feature. This solution allows for the accurate tracking of inventory and Cost of Goods Sold (COGS), ensuring financial clarity for your business. In just 15 minutes, connect all of your sales channels and enhance your bookkeeping workflow.

Trusted by numerous Shopify merchants and accountants, this solution simplifies complex accounting tasks, enabling you to focus more on business growth while ensuring financial accuracy.