Online stores have become increasingly popular as more and more people turn to the internet for their shopping needs. However, with the rise of e-commerce comes the need to understand and manage taxes in this digital landscape. In this ultimate guide, we will explore the basics of e-commerce taxation, different types of taxes for online stores, setting up tax management for your online store, navigating international taxes, and tax compliance and reporting for online stores. By the end of this guide, you will have a solid understanding of tax management for your online store and how to stay compliant with tax regulations.

Understanding the Basics of E-commerce Taxation

A fundamental aspect of tax management for online stores is understanding the basics of e-commerce taxation. Whether you are new to the world of online retail or an experienced e-commerce business owner, having a clear understanding of e-commerce tax is essential.

When delving into the realm of e-commerce taxation, it's important to recognize that the landscape is constantly evolving. Tax laws and regulations pertaining to online businesses are subject to change, influenced by factors such as technological advancements, shifts in consumer behavior, and global economic trends. Staying informed about these developments is key to navigating the complex web of e-commerce tax compliance.

Defining E-commerce Tax

E-commerce tax refers to the taxes that online retailers need to collect and remit to the appropriate tax authorities. These taxes can vary depending on the jurisdiction in which you operate and the type of products or services your online store offers.

Moreover, the concept of e-commerce tax extends beyond just sales tax. It encompasses a range of levies, including value-added tax (VAT), digital services tax, and customs duties. Understanding the specific tax obligations that apply to your e-commerce operations requires a comprehensive grasp of the intricate tax frameworks that govern online transactions.

Importance of Tax Management in E-commerce

Effective tax management is crucial for the success of your online store. Not only does it ensure compliance with tax laws and regulations, but it also helps you avoid penalties and maintain a good reputation with your customers and the tax authorities.

Furthermore, strategic tax planning can provide e-commerce businesses with a competitive edge. By optimizing tax strategies and leveraging incentives and exemptions offered by tax authorities, online retailers can enhance their profitability and sustainability in a highly competitive market. Proactive tax management is not just about meeting obligations; it is a strategic tool for driving growth and maximizing the financial health of your e-commerce venture.

Different Types of Taxes for Online Stores

When it comes to taxes for online stores, there are several types to consider. The two main types we will explore are sales tax for online retailers and value-added tax (VAT) in e-commerce.

Aside from sales tax and VAT, another important tax consideration for online stores is the digital services tax (DST). DST is a tax on revenues generated from digital services provided to customers in specific jurisdictions. This tax is designed to ensure that digital businesses contribute their fair share to the local economy.

Sales Tax for Online Retailers

Sales tax is a tax imposed by the state or local authorities on the sale of goods or services. As an online retailer, you may be required to collect sales tax from customers in certain jurisdictions. Understanding your sales tax obligations is crucial for tax management.

Moreover, some states in the U.S. have enacted marketplace facilitator laws, which require online platforms like Amazon and Etsy to collect and remit sales tax on behalf of third-party sellers. This means that as an online seller, you may not have to worry about collecting sales tax directly if you sell through these platforms.

Value Added Tax (VAT) in E-commerce

VAT is a consumption tax imposed on the value added at each stage of the supply chain. In e-commerce, VAT can be particularly complex due to cross-border sales and different VAT rates in various countries. Properly managing VAT is essential to avoid non-compliance and potential penalties.

Furthermore, in the European Union, online businesses selling digital products or services to consumers are required to comply with the VAT Mini One Stop Shop (MOSS) scheme. This scheme simplifies VAT compliance for cross-border digital sales within the EU, allowing businesses to submit VAT returns and payments in one member state.

Setting Up Tax Management for Your Online Store

Now that you have a better understanding of e-commerce taxation and the different types of taxes for online stores, it's time to set up tax management for your online store. Proper tax management is crucial for ensuring compliance with tax laws and regulations, as well as maintaining transparency and accuracy in financial transactions.

When setting up tax management for your online store, it's essential to consider the specific tax requirements that apply to your business. This includes understanding the tax rates for different products or services you offer, as well as any exemptions or special rules that may apply to certain transactions.

Selecting the Right Tax Management Software

One of the first steps in setting up tax management for your online store is selecting the right tax management software. Look for a software solution that integrates seamlessly with your e-commerce platform and provides features such as automated tax calculations, real-time tax rate updates, and detailed reporting capabilities. The right tax management software can help streamline your tax processes and reduce the risk of errors or miscalculations.

Consider choosing a software provider that offers ongoing support and updates to ensure that your tax management system remains up-to-date with the latest tax laws and regulations. Additionally, look for software that offers scalability to accommodate your business growth and expansion.

Configuring Tax Settings in Your Online Store

Once you have chosen the appropriate tax management software, the next step is to configure tax settings in your online store. This involves setting up tax rates for different jurisdictions, including state, local, and international taxes, and ensuring that your tax settings align with the relevant tax laws and regulations.

Take the time to review and test your tax settings to ensure that they are accurately applied to customer transactions. Consider conducting periodic audits of your tax management system to identify any discrepancies or areas for improvement. By proactively managing your tax settings, you can minimize the risk of non-compliance and potential penalties.

Navigating International Taxes for E-commerce

If your online store operates on an international scale, it is essential to navigate the complexities of international taxes.

Expanding your e-commerce business globally can be a lucrative endeavor, but it also comes with a myriad of tax considerations that must be taken into account. From understanding cross-border taxation to dealing with value-added tax (VAT) in different regions, being well-versed in international tax laws is crucial for the success and compliance of your online store.

Understanding Cross-Border Taxation

Cross-border taxation refers to the tax implications of conducting business across different countries. It involves understanding the tax laws of each jurisdiction and ensuring compliance with the relevant regulations.

When expanding your e-commerce operations internationally, you will encounter various tax systems, each with its own set of rules and requirements. Factors such as permanent establishment, transfer pricing, and withholding taxes can significantly impact your tax obligations. Navigating these complexities requires a comprehensive understanding of international tax treaties and agreements to avoid double taxation and ensure compliance with the laws of each country you operate in.

Dealing with VAT in the European Union

For online stores selling to customers within the European Union, dealing with VAT can be particularly challenging. The EU has specific VAT rules and regulations that must be followed. Familiarize yourself with these regulations and seek appropriate guidance to ensure compliance.

One of the key considerations when selling to EU customers is determining whether you need to register for VAT in each member state where you have customers. The distance selling thresholds, which determine when VAT registration is required in a specific country, vary across the EU and must be closely monitored to avoid non-compliance. Additionally, understanding the different VAT rates, exemptions, and invoicing requirements in each EU country is essential to ensure accurate tax collection and reporting.

Tax Compliance and Reporting for Online Stores

Complying with tax laws and reporting requirements is a critical aspect of tax management for online stores. Ensuring that your online store is in full compliance with tax regulations is not only a legal requirement but also essential for maintaining a good standing with tax authorities and avoiding potential financial penalties.

One important aspect of tax compliance for online stores is understanding the nexus rules that determine whether you have a tax obligation in a particular state or country. Nexus is the connection between a business and a taxing jurisdiction, and it can be established through various factors such as physical presence, economic activity, or the use of third-party affiliates. Being aware of nexus rules is crucial for determining where you are required to collect and remit taxes.

Keeping Accurate Records for Tax Purposes

Keeping accurate records of your online store's transactions is essential for tax purposes. This includes maintaining records of sales, expenses, and tax payments. Having organized records will make compliance and reporting processes more efficient. In addition to transaction records, it is also important to keep track of any exemptions or deductions that may apply to your online store to ensure that you are not overpaying on taxes.

Regular Reporting and Payment of Taxes

Lastly, ensure that you regularly report and pay the taxes you collect from your customers. Depending on your jurisdiction, you may have specific reporting timelines and payment due dates. Staying on top of these deadlines is crucial to avoid penalties and maintain compliance. It is recommended to set up a system to track your tax liabilities accurately and allocate funds for tax payments to prevent any cash flow issues when tax deadlines approach.

By following this ultimate guide to tax management for online stores, you will be well-equipped to handle the complexities of e-commerce taxation. Remember to stay informed about the latest tax laws and regulations, seek professional advice when needed, and prioritize tax compliance to ensure the long-term success of your online store. Upholding a proactive approach to tax compliance will not only protect your business from potential risks but also foster a positive reputation with customers and tax authorities alike.

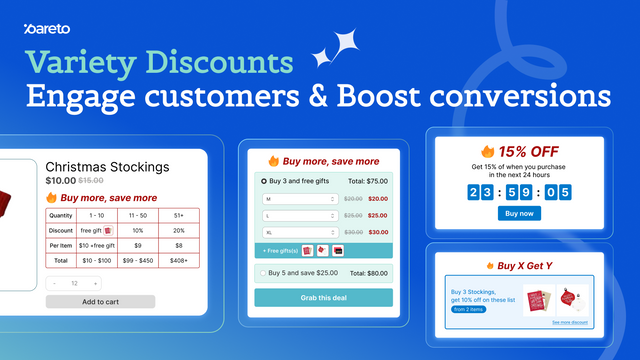

Now that you're equipped with the knowledge to manage taxes for your online store, it's time to further enhance your e-commerce operations. OwlMix is here to help you find the perfect Shopify apps to streamline your tax management and boost your store's efficiency. With our friendly mascot Owlfred guiding you through our extensive directory, you'll discover innovative solutions tailored to your needs. Don't let tax compliance slow you down—find your next Shopify app today and take your online business to the next level!