In today's digital age, seamless and efficient payment processing is an essential component of any successful online business. Ensuring optimal payment gateway performance plays a crucial role in providing a positive user experience and maximizing revenue. This comprehensive guide will delve into the various aspects of payment gateway performance optimization, including understanding its importance, key factors affecting performance, strategies for optimization, the role of technology, and how to measure performance effectively.

Understanding Payment Gateway Performance

What is Payment Gateway Performance?

Payment gateway performance refers to the speed, reliability, and security of the system responsible for processing online transactions. It encompasses various technical components and processes that facilitate seamless payment processing between customers, merchants, and financial institutions.

One key aspect of payment gateway performance is the processing speed, which directly impacts the overall checkout experience. A fast and efficient payment gateway can significantly reduce transaction times, leading to higher customer satisfaction and increased conversion rates. Additionally, the reliability of a payment gateway is crucial in ensuring that transactions are processed accurately and without interruptions, ultimately building trust with customers and merchants alike.

Why is Payment Gateway Performance Important?

High-performing payment gateways are vital for businesses to provide a smooth and secure checkout experience. Slow response times, frequent errors, or security vulnerabilities can lead to frustrated customers, abandoned shopping carts, and potential monetary losses. Therefore, optimizing payment gateway performance is crucial for enhancing customer satisfaction, increasing conversion rates, and maintaining a trustworthy online presence.

Furthermore, the security aspect of payment gateway performance cannot be understated. A secure payment gateway utilizes encryption and fraud prevention measures to protect sensitive customer information, such as credit card details, from unauthorized access. By prioritizing security in payment gateway performance, businesses can safeguard their reputation and build credibility with customers who trust them with their financial data.

Key Factors Affecting Payment Gateway Performance

Transaction Speed

One of the primary factors affecting payment gateway performance is transaction speed. Customers expect near-instantaneous processing, and delays can lead to increased cart abandonment rates. Optimizing server response times, reducing network latency, and implementing efficient transaction protocols are essential for ensuring fast and seamless payment processing.

Moreover, in today's fast-paced digital world, the demand for real-time transactions is on the rise. Payment gateways need to leverage cutting-edge technologies such as machine learning and AI to predict and process transactions swiftly, providing customers with a frictionless payment experience.

Security Measures

Security is paramount in the world of online payments. Payment gateways must comply with industry standards and incorporate robust security measures to protect sensitive customer data. Implementing encryption, tokenization, and secure authentication protocols are crucial for safeguarding transactions and instilling customer trust.

Furthermore, with the increasing sophistication of cyber threats, payment gateways need to stay ahead of potential security breaches. Regular security audits, penetration testing, and ongoing staff training on cybersecurity best practices are vital to maintaining a secure payment environment for both businesses and consumers.

Integration Capabilities

The ability to integrate with various platforms and software is another critical factor in payment gateway performance. Seamless integration with e-commerce platforms, shopping carts, and other third-party applications ensures smooth data flow, reduces errors, and simplifies the overall payment processing experience.

Additionally, as the digital ecosystem continues to evolve, payment gateways must adapt to new technologies and emerging trends. APIs play a crucial role in enabling seamless integrations, allowing businesses to connect their payment systems with a wide range of applications and services, ultimately enhancing the overall efficiency and effectiveness of the payment gateway.

Strategies for Optimizing Payment Gateway Performance

Choosing the Right Payment Gateway

The first step in optimizing payment gateway performance is selecting the right gateway for your business needs. Consider factors such as transaction volume, supported payment methods, security features, scalability, and integration capabilities when evaluating potential payment gateway providers.

Furthermore, it's essential to assess the level of customer support provided by the payment gateway vendor. A responsive and knowledgeable support team can make a significant difference in resolving any issues or concerns that may arise during integration or operation. Look for a provider that offers 24/7 support to ensure timely assistance whenever you need it.

Regular Performance Testing

Regularly testing and monitoring the performance of your payment gateway is crucial for identifying bottlenecks, weaknesses, and areas for improvement. Conduct load testing, stress testing, and security audits to ensure optimal performance and reliability, particularly during peak transaction periods.

In addition to performance testing, consider implementing real-time monitoring tools that provide insights into transaction processing times, error rates, and other key performance indicators. By proactively monitoring your payment gateway's performance, you can quickly address any issues that may impact the user experience or lead to transaction failures.

Implementing Security Enhancements

Continuously enhancing the security of your payment gateway is vital in today's ever-evolving threat landscape. Stay up-to-date with the latest security standards and industry best practices. Implement two-factor authentication, fraud detection systems, and other advanced security measures to protect against payment fraud and data breaches.

Moreover, consider conducting regular security audits and penetration testing to identify and address potential vulnerabilities in your payment gateway infrastructure. Collaborate with cybersecurity experts to ensure that your security measures are robust and effective in safeguarding sensitive payment information from malicious actors.

The Role of Technology in Payment Gateway Optimization

The Impact of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) technologies have revolutionized various industries, including payment processing. AI-powered risk assessments, fraud detection algorithms, and predictive analytics can enhance security, streamline processes, and identify patterns that optimize transaction routing and improve overall payment gateway performance.

Furthermore, AI and ML can also be utilized to personalize the payment experience for customers. By analyzing transaction data and customer behavior, these technologies can offer tailored recommendations, such as preferred payment methods or customized security settings, leading to higher customer satisfaction and increased conversion rates.

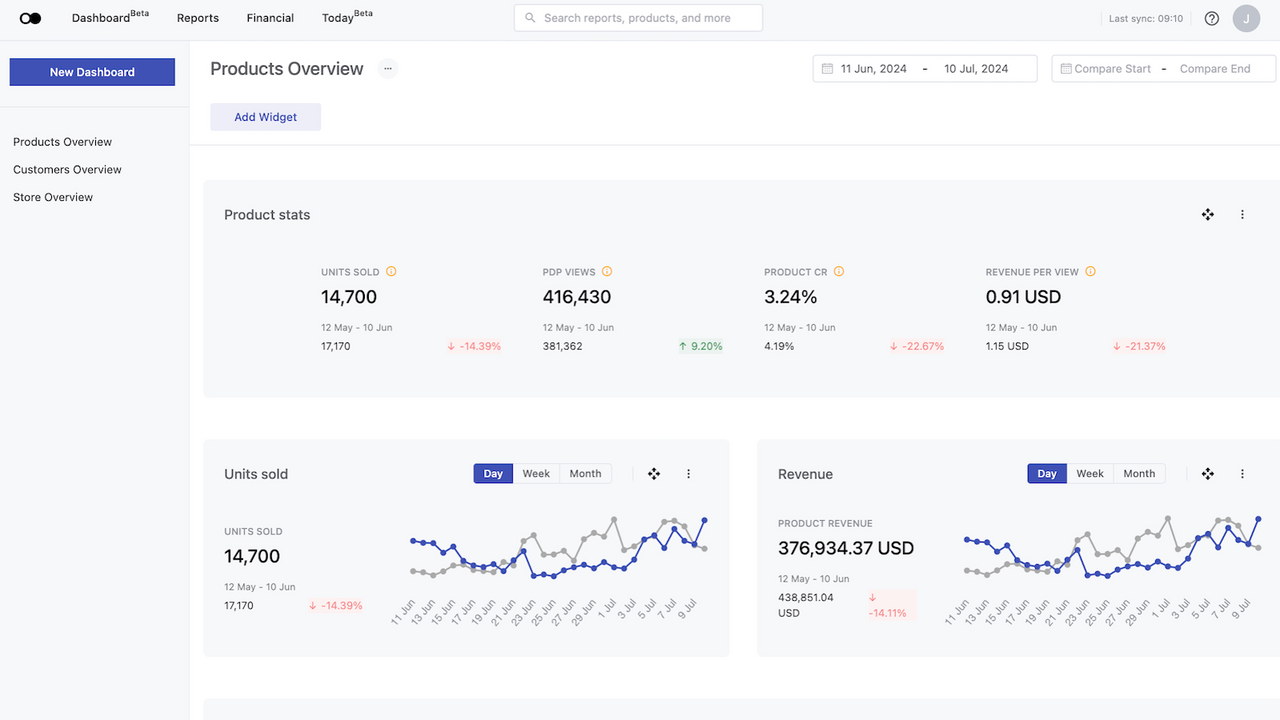

The Importance of Real-Time Analytics

Real-time analytics provide valuable insights into the performance of your payment gateway. Tracking key metrics such as transaction success rates, response times, and error rates allows you to identify potential issues promptly, make data-driven optimizations, and ensure smooth payment processing for your customers.

In addition to monitoring transaction-related metrics, real-time analytics can also help in detecting emerging trends and consumer preferences. By analyzing data as it flows through the payment gateway, businesses can adapt their strategies quickly to meet changing customer demands, stay ahead of the competition, and drive revenue growth.

Measuring Payment Gateway Performance

Key Performance Indicators (KPIs)

Measuring payment gateway performance requires the identification and tracking of relevant Key Performance Indicators (KPIs). Common KPIs include average transaction time, transaction success rate, decline rate, and chargeback rate. These metrics help gauge the overall efficiency and effectiveness of your payment gateway.

Another crucial KPI to consider is the authorization rate, which measures the percentage of successful transactions out of the total attempted transactions. A high authorization rate indicates a smooth payment process, while a low rate may signal underlying issues that need to be addressed promptly.

Regular Monitoring and Reporting

Monitoring and reporting on payment gateway performance should be an ongoing practice. Regularly review performance metrics, generate comprehensive reports, and analyze trends to identify areas for improvement. Utilize monitoring tools and dashboards to ensure optimal performance and proactively address any issues that may arise.

Moreover, conducting A/B testing on your payment gateway can provide valuable insights into user behavior and preferences, helping you fine-tune the checkout process for better conversion rates. By experimenting with different payment methods, page layouts, or security features, you can optimize the user experience and ultimately boost your bottom line.

By understanding the importance of payment gateway performance, identifying key factors affecting performance, implementing optimization strategies, leveraging technology, and measuring performance effectively, businesses can maximize the efficiency, reliability, and security of their payment processing systems. Prioritizing payment gateway optimization ultimately leads to improved customer satisfaction, increased conversions, and sustained growth in the competitive online marketplace.

Ready to elevate your Shopify store's payment gateway and overall performance? Let Owlfred, your wise companion from OwlMix, guide you to the perfect tools for success. With our curated directory of innovative Shopify apps, you can enhance every aspect of your online business, from seamless payment processing to user experience. Don't miss out on the opportunity to optimize your store and delight your customers. Find your next Shopify app today and watch your e-commerce experience take flight!