In today's competitive e-commerce landscape, offering diverse payment options is crucial for the success of your Shopify store. By understanding the importance of multiple payment options and evaluating your current system, you can optimize your payment system to enhance customer experience, increase conversion rates, and cater to a global audience. In this article, we will explore different ways to enhance payment options for your Shopify store and provide you with a step-by-step guide to implementing new payment methods.

Understanding the Importance of Diverse Payment Options

When it comes to online shopping, customers have different preferences for how they want to pay. By offering diverse payment options, you can meet the unique needs of your customers and increase their satisfaction with their shopping experience. Additionally, having multiple payment options can improve your store's credibility and attract a wider customer base.

One important aspect to consider when it comes to diverse payment options is the convenience it provides to customers. Imagine a scenario where a customer is ready to make a purchase on your Shopify store, but they find that their preferred payment method is not available. This can be frustrating for the customer and may lead them to abandon their purchase altogether. However, by offering a wide range of payment options, you can ensure that customers can easily use their preferred method, increasing the likelihood of completing the purchase and boosting customer satisfaction.

Furthermore, diverse payment options can also play a crucial role in building trust and credibility for your online store. When customers see that you offer a variety of payment methods, it gives them confidence that your store is legitimate and trustworthy. This is especially important for new or lesser-known businesses that are trying to establish themselves in the market. By providing diverse payment options, you can instill trust in potential customers and encourage them to make a purchase.

The Role of Payment Options in Customer Experience

The payment process is a critical part of the overall customer experience. By providing a seamless and convenient payment experience, you can enhance customer satisfaction and build trust in your brand. Customers are more likely to complete their purchase if they can easily use their preferred payment method.

One way to improve the customer experience is by offering popular payment options that are widely used and trusted. For example, integrating payment gateways such as PayPal, Stripe, or Apple Pay can provide customers with a familiar and secure payment method. These payment gateways have built-in security measures that protect customer information, giving them peace of mind when making a purchase on your store.

Moreover, offering diverse payment options can also cater to specific customer preferences. Some customers may prefer to use digital wallets, while others may prefer traditional credit or debit card payments. By accommodating these preferences, you can create a personalized and tailored shopping experience for each customer, increasing their satisfaction and likelihood of returning to your store in the future.

How Payment Options Affect Conversion Rates

Conversion rates play a significant role in determining the success of your Shopify store. Offering a limited number of payment options may discourage potential customers from completing their purchase. By expanding your payment options, you can reduce barriers to purchase and increase conversion rates.

When customers have limited payment options, they may hesitate to proceed with the purchase if their preferred method is not available. This hesitation can lead to abandoned carts and lost sales opportunities. However, by offering a wide range of payment options, you can eliminate this hesitation and encourage customers to complete their purchase. This, in turn, can significantly improve your conversion rates and ultimately contribute to the growth and success of your online store.

Furthermore, it is important to keep in mind that different customers have different preferences when it comes to payment methods. Some customers may prefer the convenience of digital wallets, while others may prefer the security of credit card payments. By offering diverse payment options, you can cater to these preferences and ensure that no potential customer is turned away due to a lack of suitable payment options. This inclusivity can have a positive impact on your conversion rates and help you reach a wider audience.

Evaluating Your Current Payment System

Before you can enhance your payment options, it's essential to evaluate your current system and identify any limitations. Take a closer look at the payment methods you currently offer and assess how well they meet the needs of your customers.

When evaluating your current payment system, it's important to consider various factors that could impact the effectiveness and efficiency of your payment methods. One key aspect to examine is the limitations of your existing payment options. Are there any payment options that your customers frequently request but are not available? Understanding these gaps in your current system can help you identify areas for improvement and expansion.

Another aspect to consider is the potential geographic restrictions or compatibility issues with certain payment solutions. In today's global marketplace, it's crucial to ensure that your payment methods can cater to customers from different regions and countries. By identifying any geographic limitations, you can explore alternative payment options that can better serve your diverse customer base.

Identifying Limitations of Your Existing Payment Options

Consider the limitations of your current payment methods. Are there any payment options that your customers frequently request but are not available? Are there any geographic restrictions or compatibility issues with certain payment solutions? Identify these limitations to better understand the gaps in your current system.

Furthermore, it's important to assess the security measures in place for your existing payment options. With the increasing prevalence of online fraud and data breaches, it's crucial to prioritize the safety of your customers' sensitive information. By evaluating the security features of your current payment system, you can determine if any enhancements or additional measures are necessary to protect your customers' data.

Assessing Customer Feedback on Payment Methods

Your customers' feedback can provide valuable insights into their payment preferences and any issues they may have encountered during the checkout process. Utilize customer surveys, reviews, and support channels to gather feedback on your existing payment methods. This feedback will help you prioritize which new payment options to explore.

Additionally, analyzing customer feedback can help you identify any pain points or friction in the payment process. Are there any common complaints or difficulties that customers face when using your current payment options? By addressing these issues, you can improve the overall user experience and increase customer satisfaction.

Furthermore, customer feedback can shed light on emerging payment trends and preferences. As technology continues to evolve, new payment methods and platforms may gain popularity among your target audience. By staying attuned to customer feedback, you can adapt your payment system to meet the evolving needs and expectations of your customers.

Exploring Different Payment Options for Shopify

Shopify offers a range of built-in payment options as well as integrations with third-party payment gateways. Understanding these options will allow you to choose the ones that align with your business model and cater to your target audience.

Overview of Shopify's Inbuilt Payment Options

Shopify provides several inbuilt payment options, including Shopify Payments, which allows you to accept credit card payments directly on your store. This option eliminates the need for third-party integrations but may have certain restrictions based on your location or business type. Additionally, Shopify integrates with popular payment gateways like PayPal and Stripe, offering alternatives for customers who prefer these services.

Third-Party Payment Gateways: Pros and Cons

Third-party payment gateways can provide additional flexibility and customization options for your payment system. These gateways, such as Authorize.Net, Braintree, or Klarna, allow you to accept a wide range of payment methods, including alternative payment options like digital wallets and cryptocurrencies. However, they may require additional setup and transaction fees.

Implementing New Payment Options on Shopify

Once you have identified the new payment options you want to offer, it's time to implement them on your Shopify store. Follow these steps to seamlessly integrate new payment methods into your system:

Step-by-Step Guide to Adding New Payment Methods

- Research and select the payment gateway or solution that best fits your business needs.

- Sign up for the chosen payment gateway and complete the necessary setup steps.

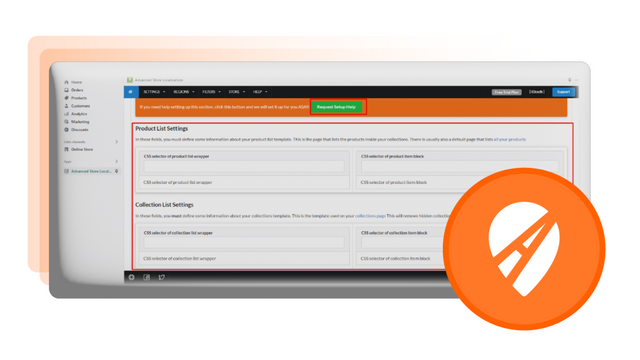

- Configure the payment gateway settings within your Shopify admin panel.

- Test the new payment method to ensure it works correctly and provides a smooth customer experience.

- Communicate the availability of the new payment options to your customers through marketing channels and on your website.

Ensuring Security and Compliance When Adding Payment Options

When implementing new payment options, it's crucial to prioritize the security of your customers' financial information. Make sure the payment gateway you choose adheres to industry-standard security protocols and complies with relevant regulations such as PCI DSS. Display trust indicators, such as SSL certificates and security badges, to reassure customers that their data is protected.

Optimizing Your Payment System for Global Customers

If you want to expand your customer base to international markets, offering multi-currency payment options is essential. Understanding the need for local payment methods and accommodating different currencies will help you provide a seamless checkout experience regardless of the customer's location.

The Need for Multi-Currency Payment Options

By accepting multiple currencies, you eliminate the need for customers to manually convert prices and reduce any potential confusion or frustration that may arise from currency conversions. Additionally, offering local payment methods can help overcome barriers to purchase for international customers who may not have access to traditional credit card payments or prefer alternative payment options.

Local Payment Methods for International Markets

Research the preferred payment methods in the countries you are targeting. For example, customers in China may prefer using Alipay or WeChat Pay, while customers in Europe may prefer SEPA Direct Debit or Sofort. Integrating these local payment methods will help you provide a localized shopping experience and build trust with international customers.

In conclusion, enhancing payment options for your Shopify store is a vital step in optimizing your e-commerce business. By understanding the importance of diverse payment options, evaluating your current system, exploring different options, implementing new payment methods, and optimizing for global customers, you can provide a seamless and convenient checkout experience that drives customer satisfaction and increases conversion rates. Take the time to assess your payment options and invest in expanding and improving them to stay competitive in the ever-changing e-commerce landscape.

Ready to take your Shopify store's payment options to the next level? Let Owlfred, your wise companion from OwlMix, guide you through our extensive directory of innovative Shopify apps. Whether you're looking to expand your payment gateways, enhance customer experience, or tap into international markets, OwlMix has the perfect tools to help you succeed. Don't miss out on the opportunity to optimize your e-commerce business. Find your next Shopify app today and watch your store thrive!