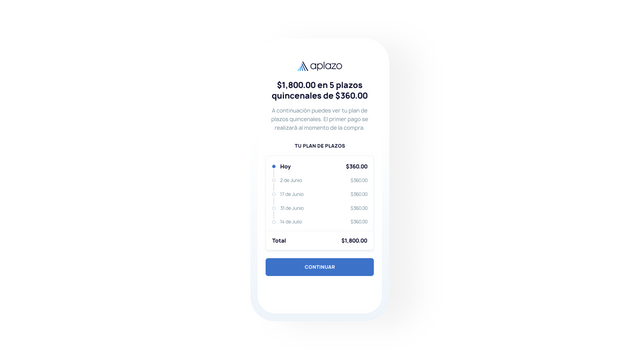

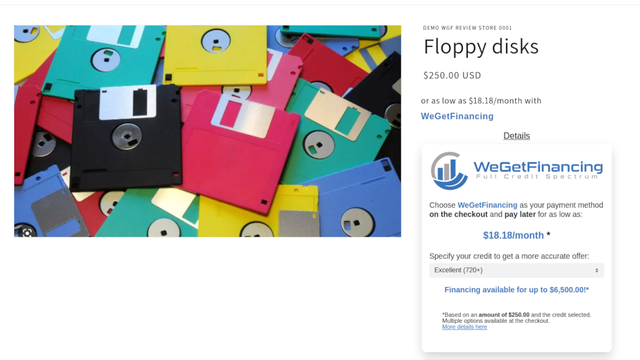

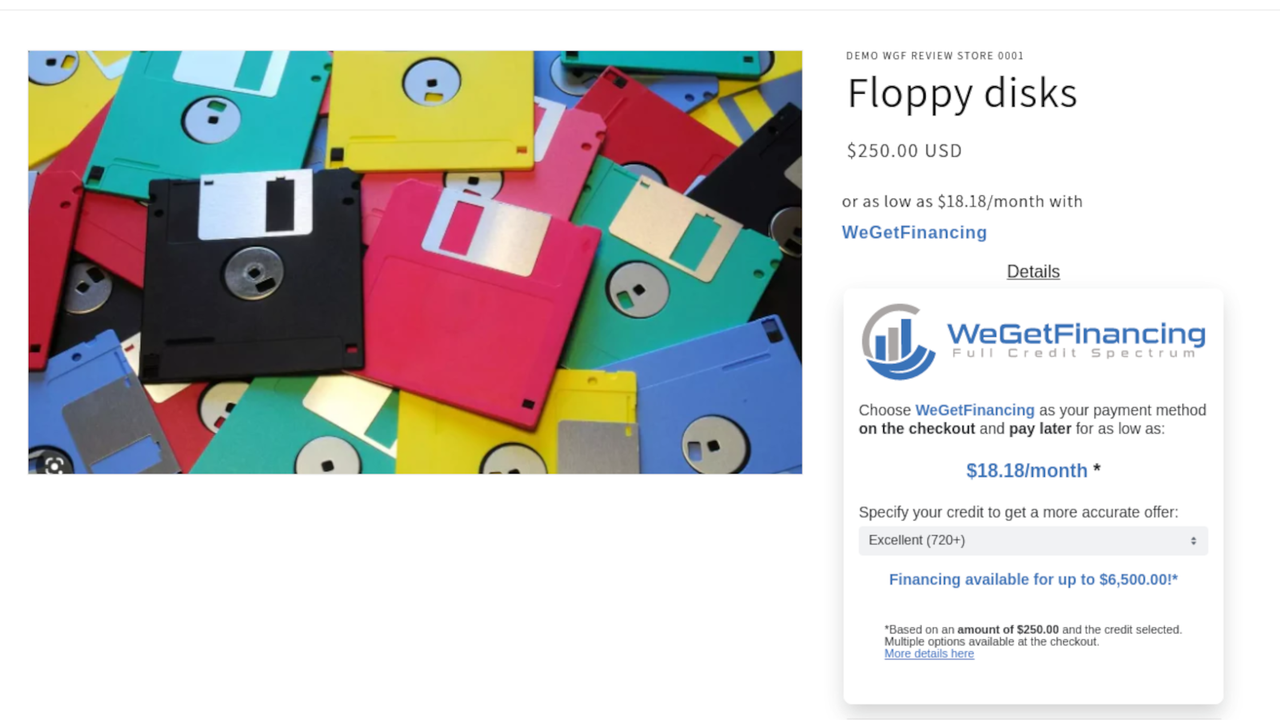

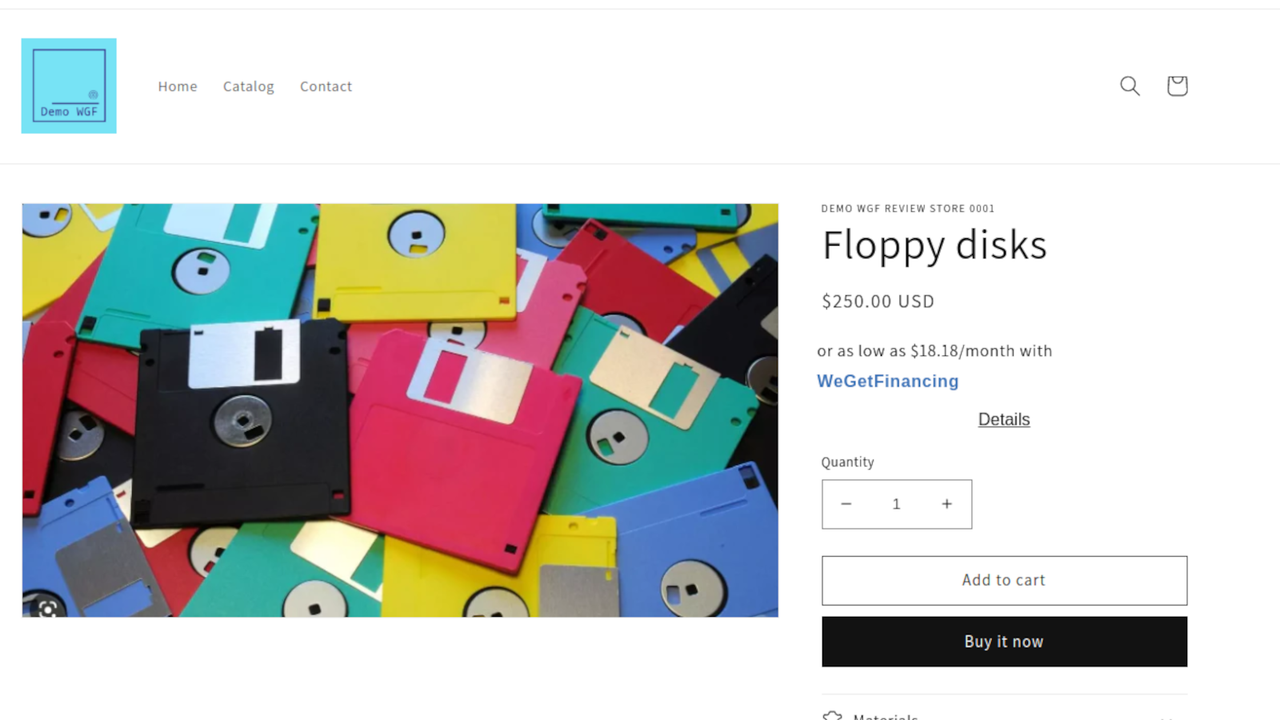

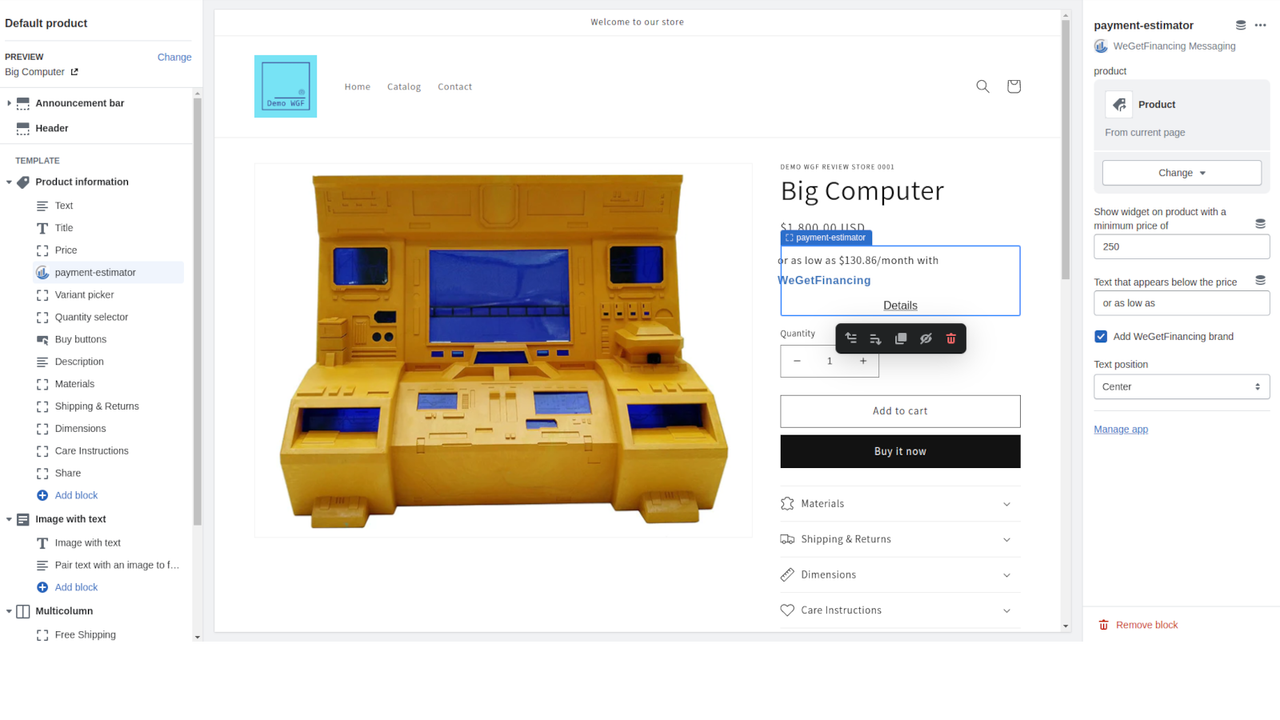

Transform the shopping experience with a tool that empowers customers to take control of their financing options directly on the product page. The Purchase Power Estimator enables buyers to easily select their credit range, providing clear projections of monthly payments associated with their purchases.

This intuitive feature not only clarifies payment possibilities for customers but also significantly impacts the merchant's metrics—leading to higher click-through rates, increased average order values, and improved conversion rates. By simplifying the financing process, this tool enhances customer confidence, allowing for informed decision-making.

Seamlessly integrate this solution into the online store to unlock potential sales and elevate customer satisfaction, ensuring a more engaging shopping journey. Start optimizing today for a smarter, more strategic approach to financing options.

WeGetFinancing Messaging

WeGetFinancing Messaging Razorpay Affordability Widget

Razorpay Affordability Widget