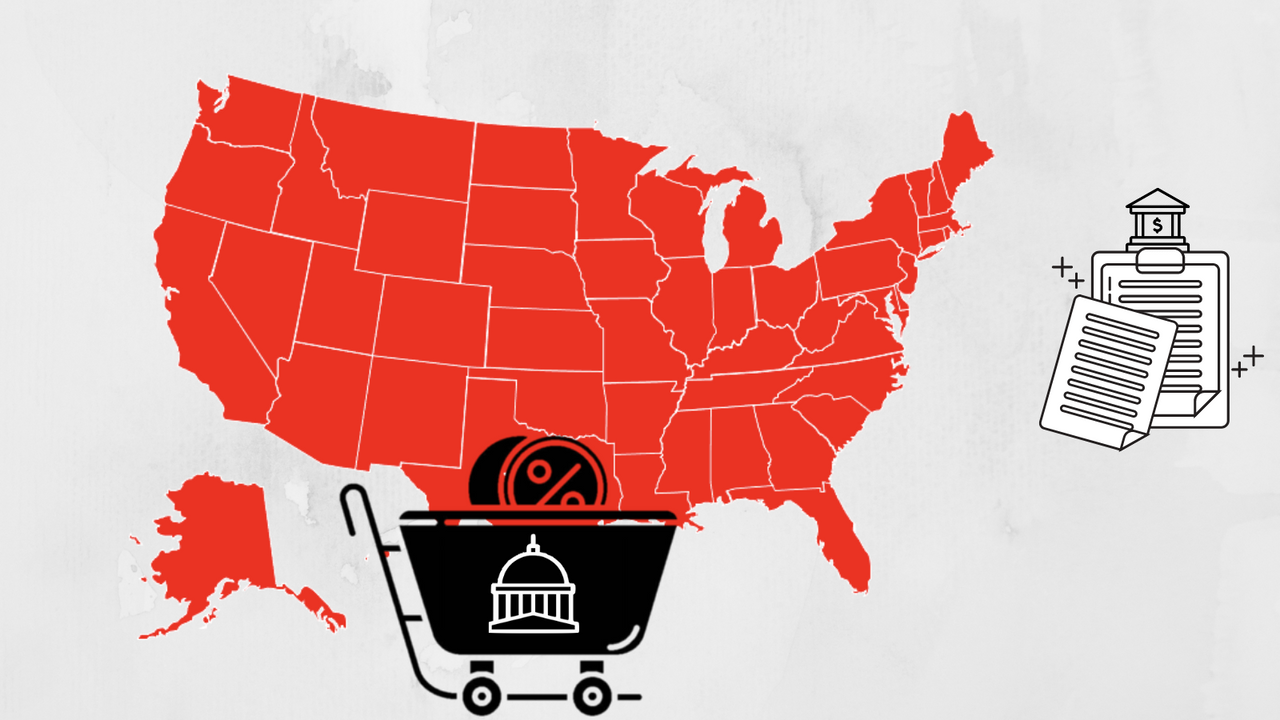

When comparing the Avalara RSB – Sales Tax Filing App and the LOVAT Compliance App, we can see that both applications offer automated tax reporting and simplified tax management for improved accuracy and compliance. However, there are some key differences between the two.

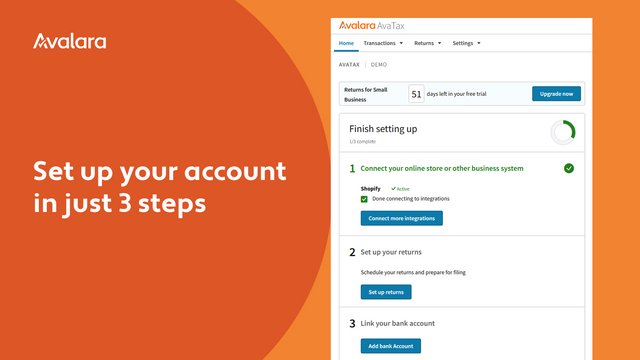

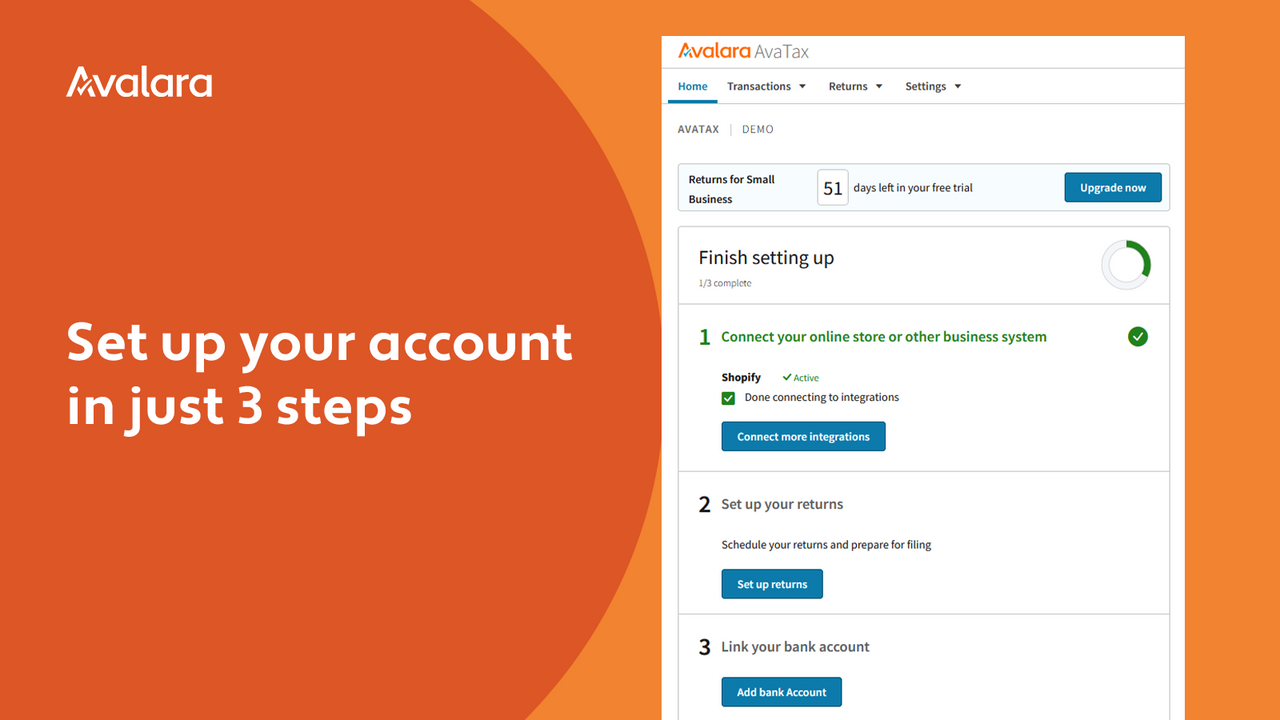

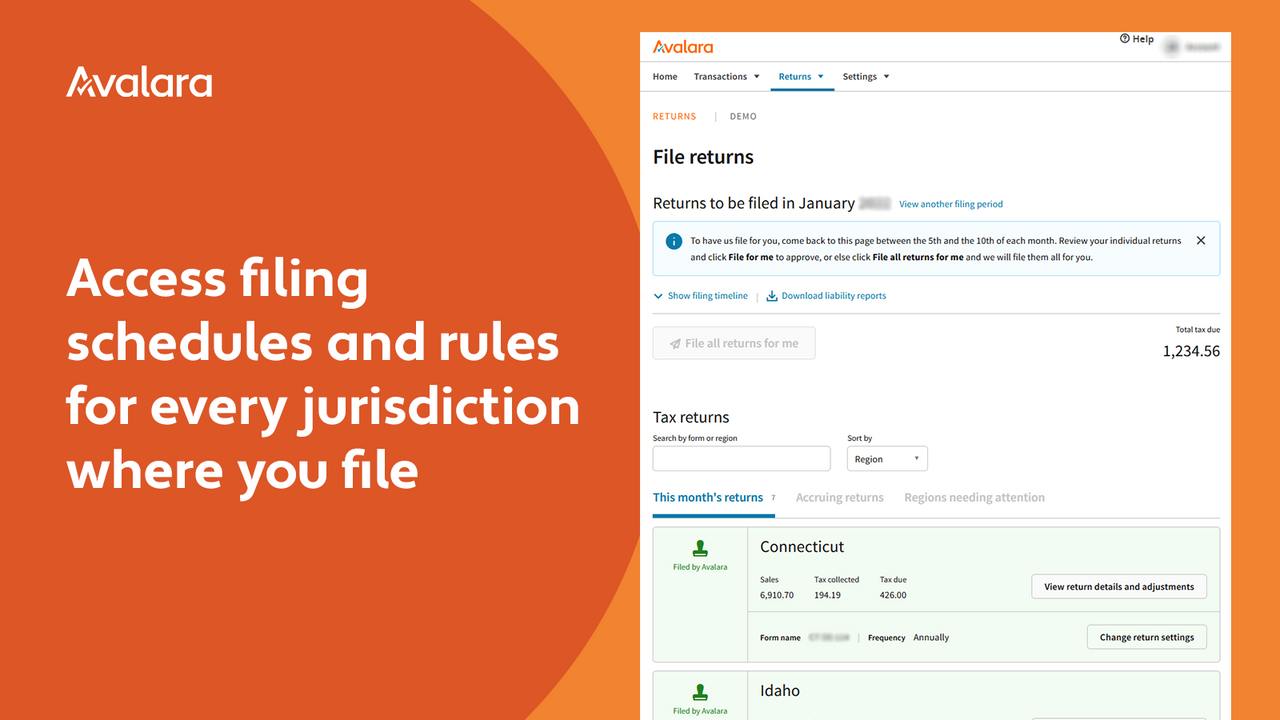

Firstly, the Avalara RSB app specifically targets small businesses and streamlines sales tax processing by tapping into Shopify sales data. It eliminates the hassle of navigating each state's website individually for filing, creating tax returns for all relevant states. The app also provides personalized information tailored to the laws of each state, ensuring compliance with state-specific tax regulations. In addition, users receive monthly reminders to stay compliant and avoid penalties. Overall, the Avalara RSB app offers a comprehensive solution for sales tax return preparation and filing with advanced features accessible to Shopify Plus customers.

On the other hand, the LOVAT Compliance App offers a broader approach to tax management, catering to both VAT and sales tax reporting liabilities. The app presents an intuitive interface that simplifies complex tax-related tasks into achievable online steps, making it accessible to anyone. It also provides access to global tax authorities for seamless operations. This app focuses on eliminating guesswork and facilitating efficient e-commerce management with its sophisticated algorithm-powered tool. With its emphasis on partnership and ambition for success, the LOVAT Compliance App aims to be more than just a tool but a facilitator of tax management processes.

Considering these differences, we recommend the Avalara RSB – Sales Tax Filing App for small businesses looking for a streamlined sales tax processing solution with personalized state-specific information and reminders for compliance. However, for businesses with a broader scope of tax management needs, the LOVAT Compliance App may provide a more comprehensive solution with its intuitive interface and access to global tax authorities.

Avalara RSB – Sales Tax Filing

Avalara RSB – Sales Tax Filing LOVAT Compliance

LOVAT Compliance