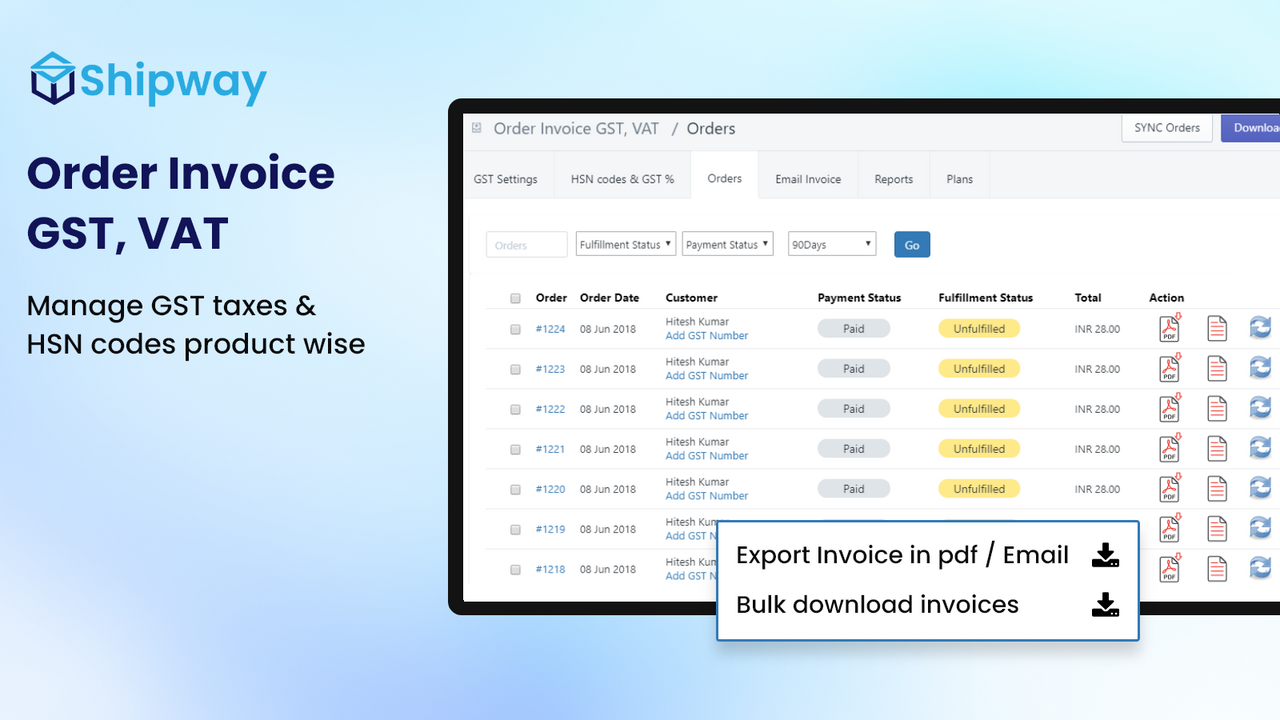

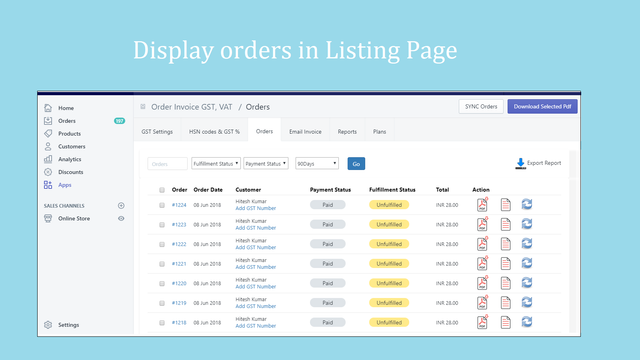

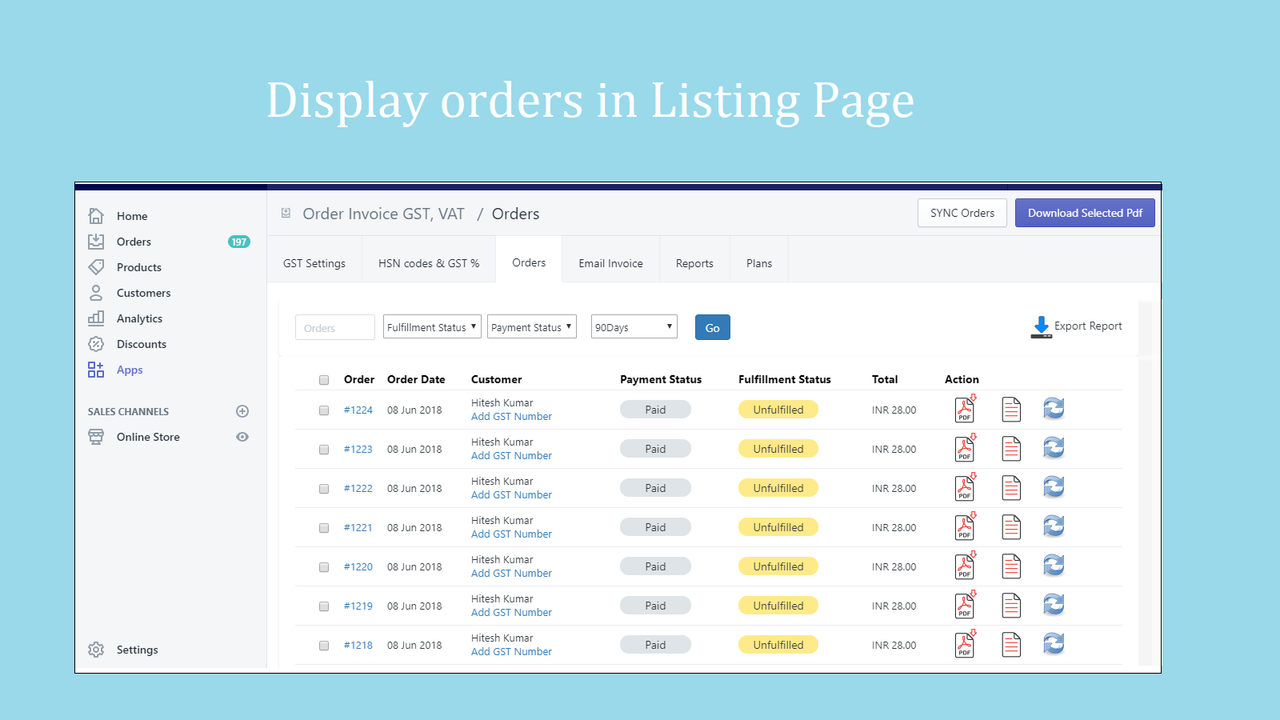

Streamlining tax compliance can be a daunting task, especially when managing invoices under the intricate framework of GST regulations. This application simplifies the invoicing process by automatically generating accurate GST-compliant invoices tailored to both intra-state and inter-state transactions.

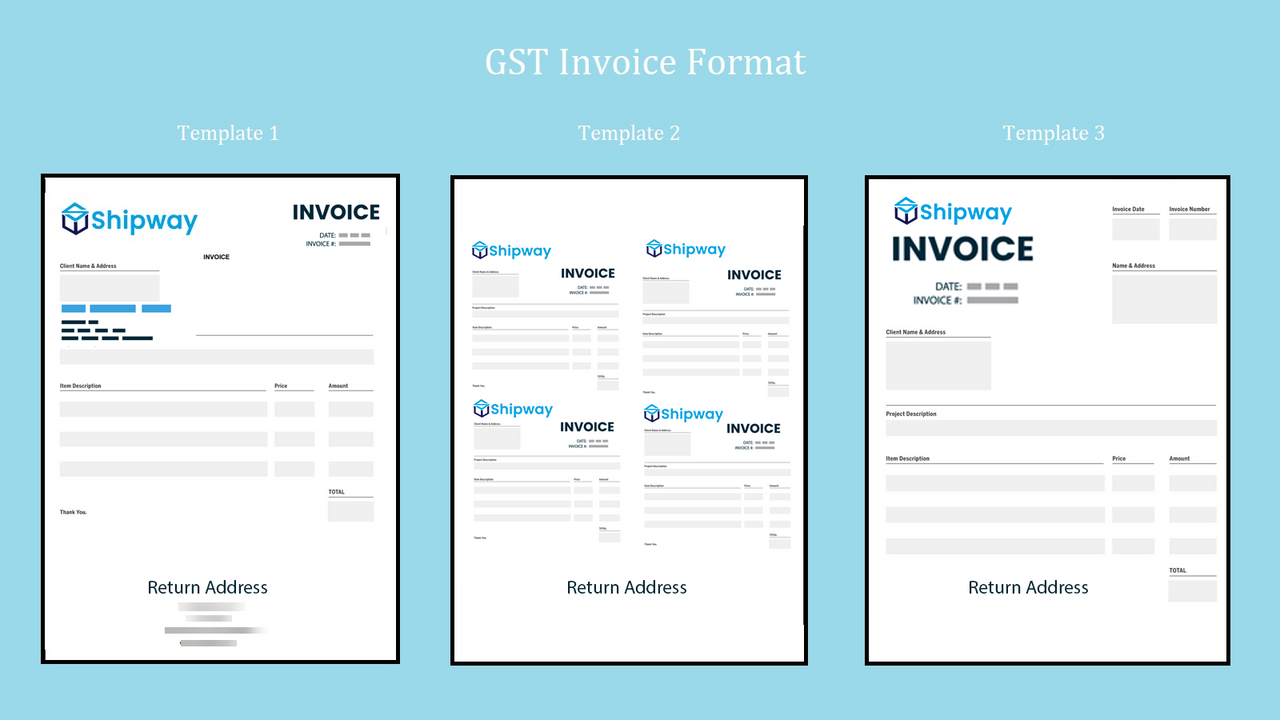

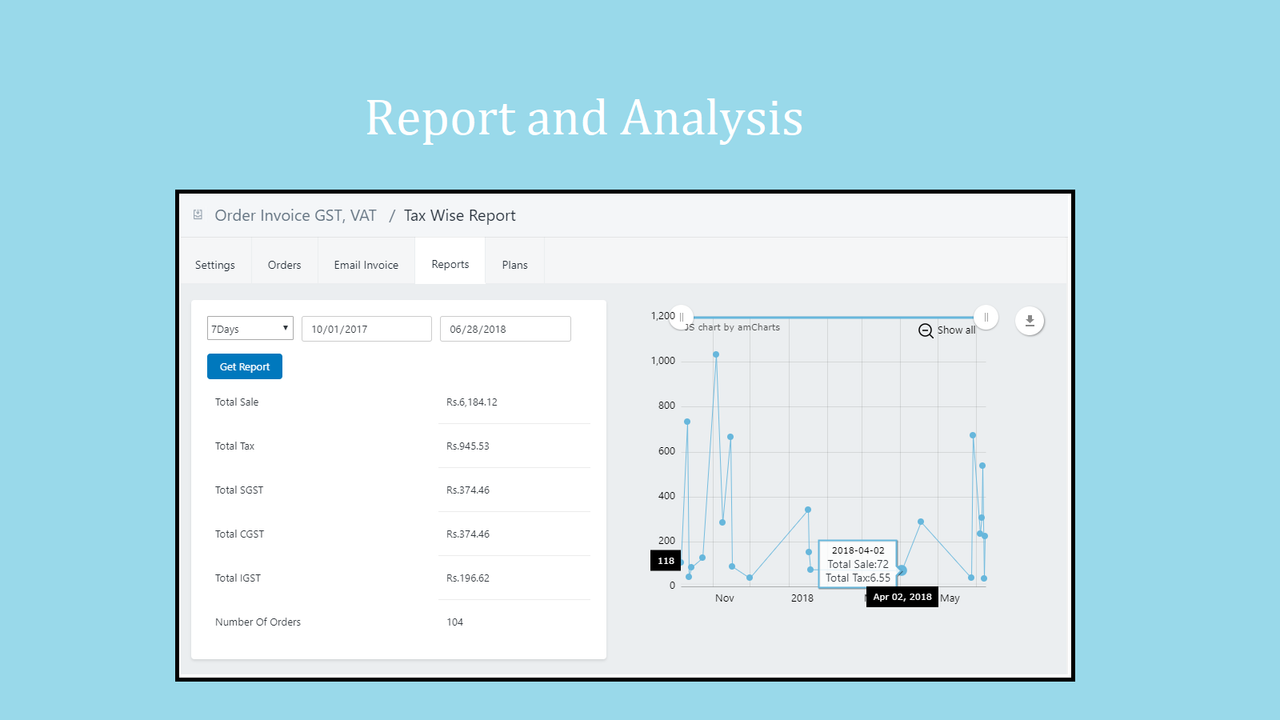

Seamlessly integrate essential invoice details, including supplier information, shipping and billing addresses, and HSN Codes. The application applies GST rates appropriately, ensuring that Central GST (CGST), State GST (SGST), and Integrated GST (IGST) calculations are accurate, eliminating the risk of errors that could lead to compliance issues.

Efficient management of your invoicing needs not only saves time but also minimizes the complexities involved in handling taxes. This tool is designed to empower users, allowing them to focus on growth while ensuring adherence to tax laws.

Optimize your operational workflow with precise, automated invoicing that aligns with current government norms. Simplify tax reporting and maintain transparency with this essential tool tailored for modern commerce.

Order Invoice GST, VAT

Order Invoice GST, VAT GST Invoice Guru Free

GST Invoice Guru Free