When comparing the EAS EU & UK Compliance App to the LOVAT Compliance App, it is clear that both apps offer features and benefits that can greatly improve your company's tax compliance processes. However, there are key differences that set these apps apart.

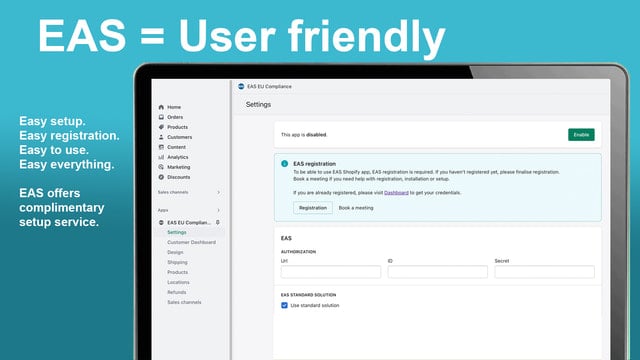

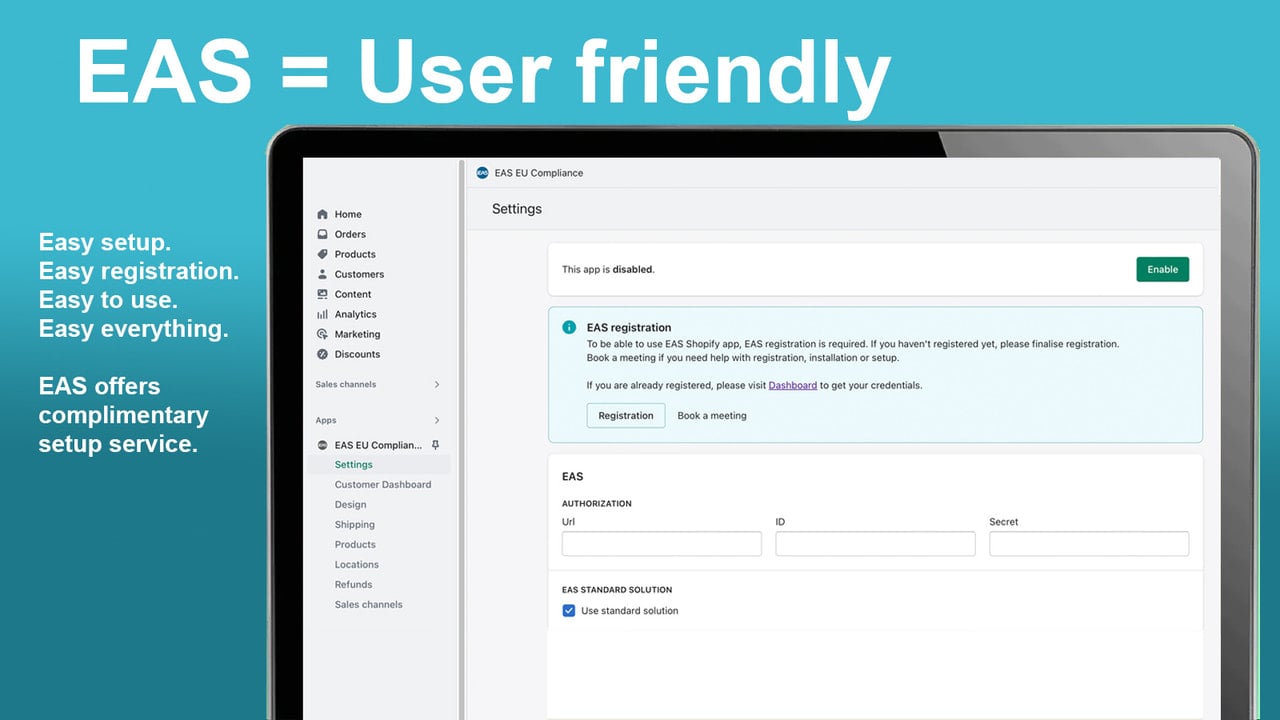

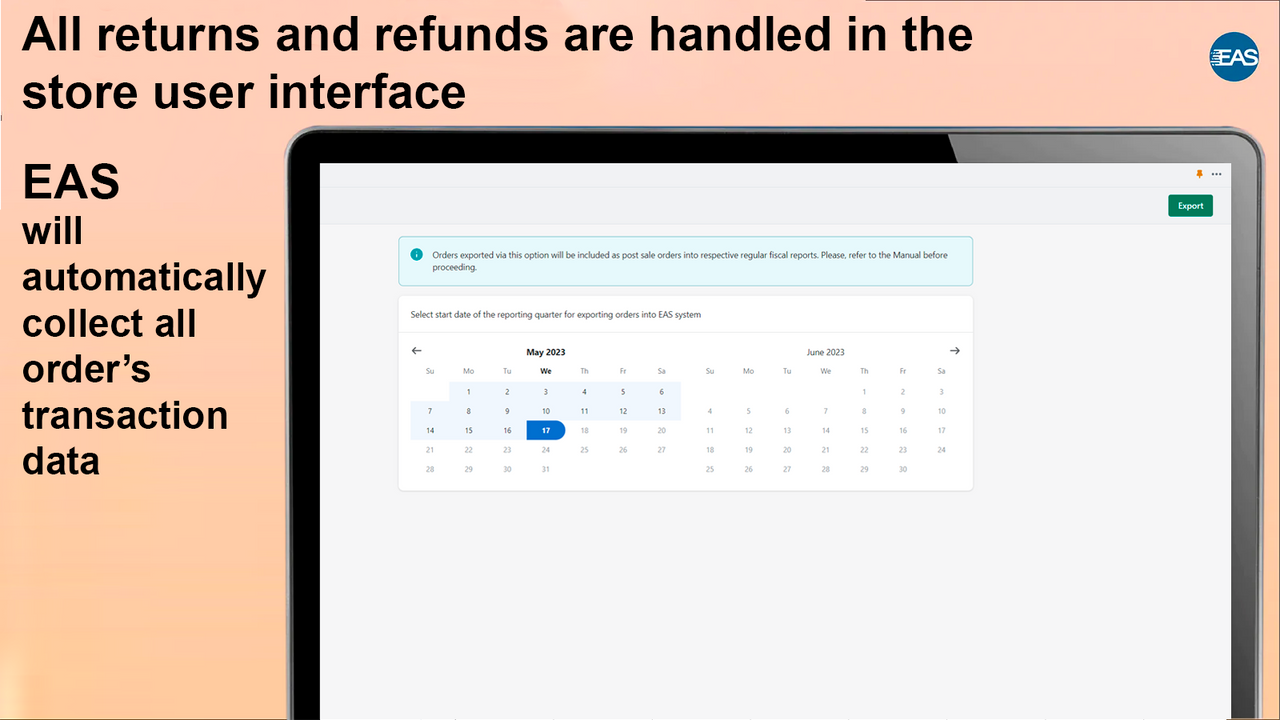

The EAS EU & UK Compliance App stands out with its comprehensive solution that streamlines and automates EU and UK sales processes. With automation for IOSS, OSS, Non-Union, and UK VAT, this app makes selling across borders incredibly easy. It caters to every business model and adapts to changing business requirements, ensuring a smooth transition to automated operations. Onboarding is a breeze and it optimizes operations to function on autopilot. Overall, this app is a go-to resource for merchants aiming to scale with ease.

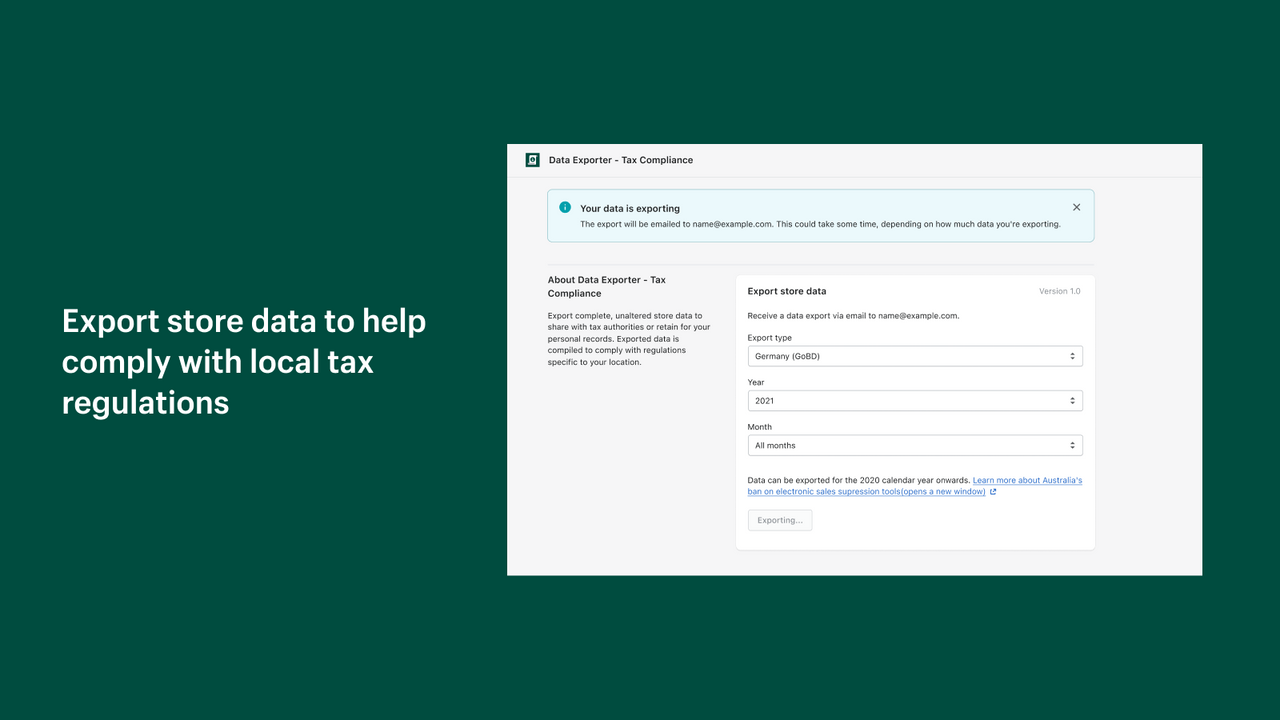

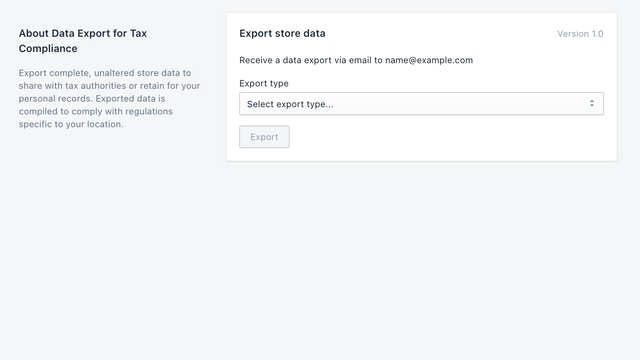

On the other hand, the LOVAT Compliance App offers an intuitive interface that simplifies complex tax-related tasks and problems. It provides automated tax reporting, simplified tax management, and access to global tax authorities for seamless operations. With its advanced technologies, this app takes the guesswork out of tax compliance and allows you to invest your time and resources into strategies for success. It truly functions as a partner, facilitating your tax management processes to make them achievable.

In conclusion, both apps have their strengths and depending on your specific needs, one may be more suitable for your company than the other. However, we highly recommend the EAS EU & UK Compliance App for its comprehensive solution, quick integration, and ability to support various business models. With its streamlined automation and efficient operations, this app is the ideal choice for merchants looking to scale and expand into new markets.

EAS EU & UK Compliance

EAS EU & UK Compliance LOVAT Compliance

LOVAT Compliance