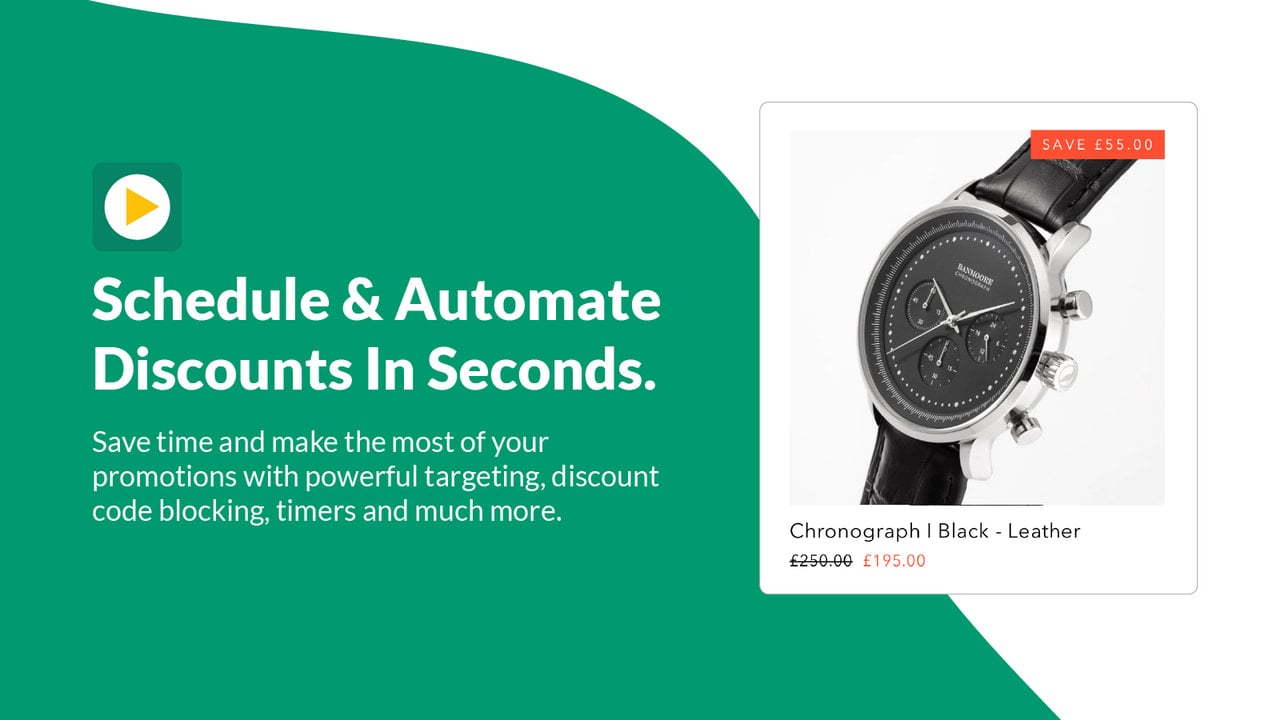

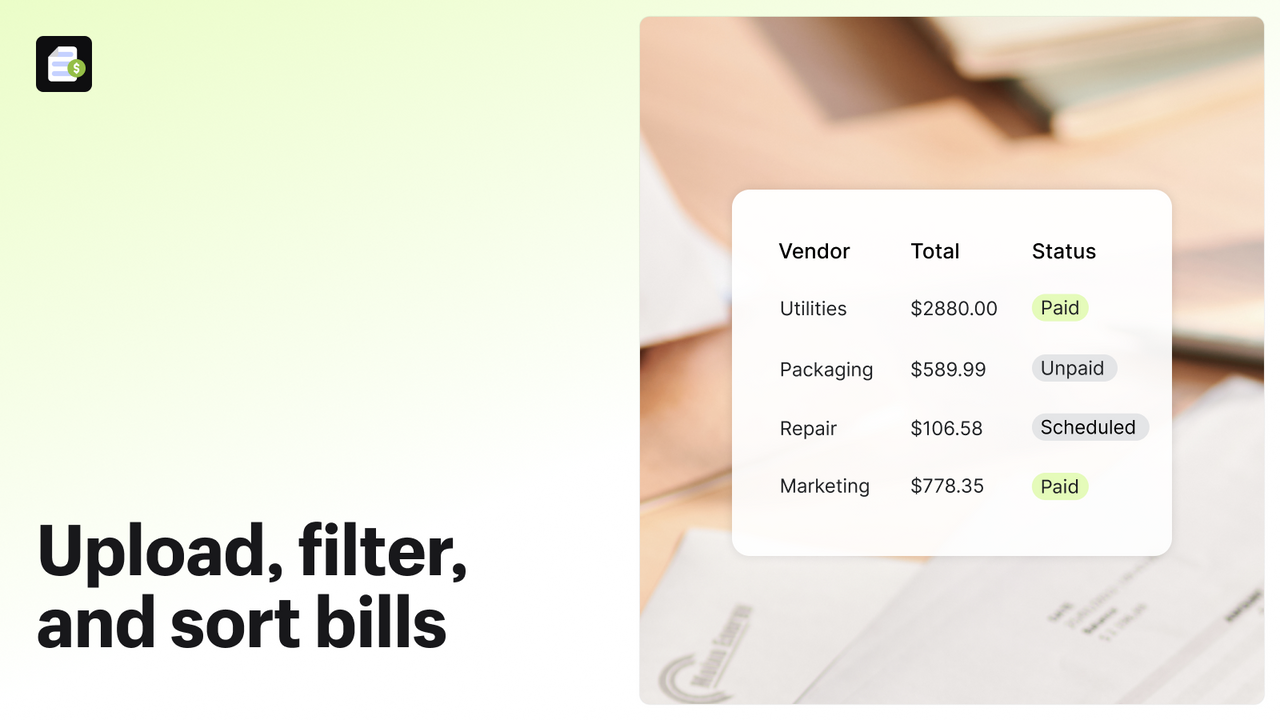

Streamline business payments effortlessly with a comprehensive solution designed for efficiency and ease. This platform allows merchants to effortlessly schedule and manage all payments, consolidating financial operations into one accessible location.

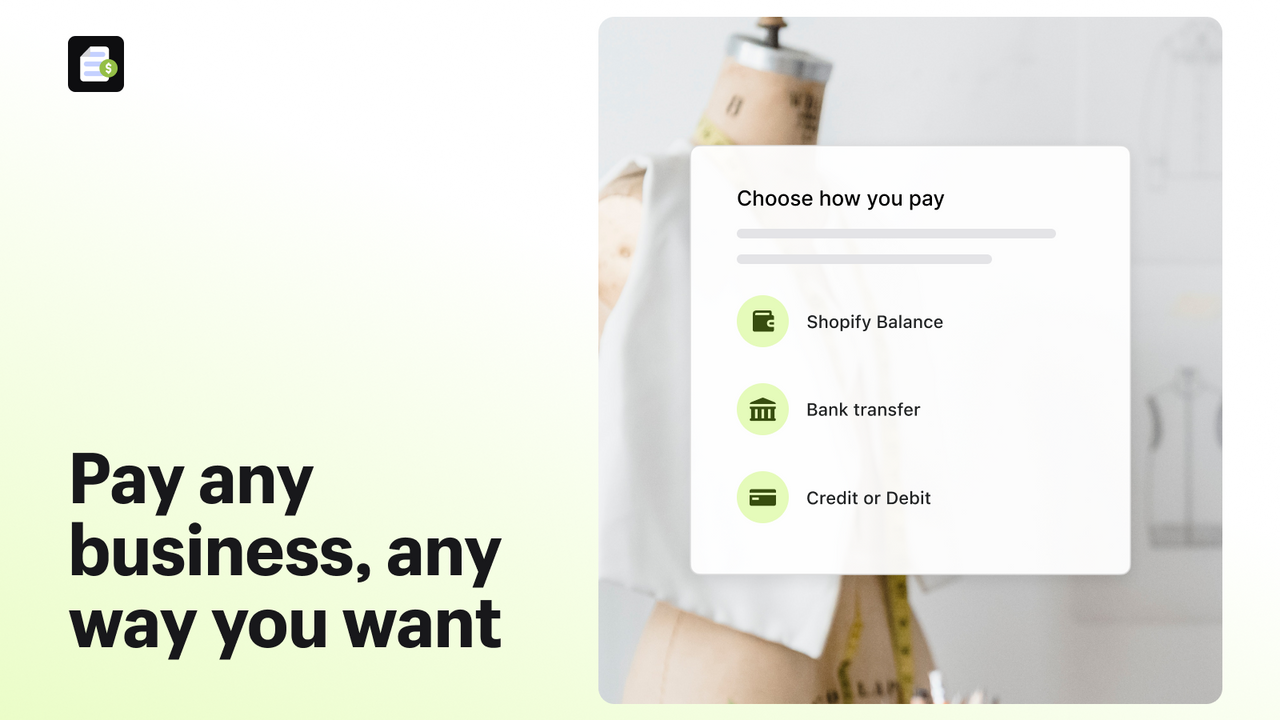

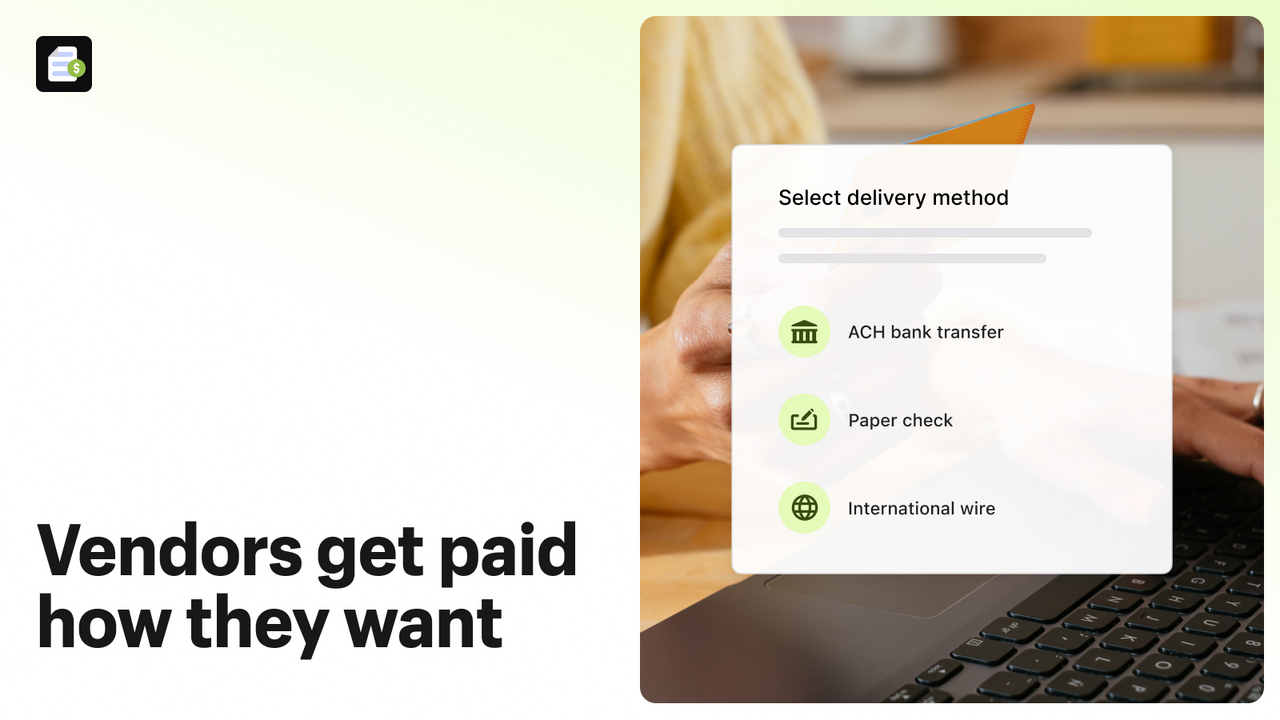

The functionality enables payment of business bills using a variety of methods including Shopify Balance accounts, debit and credit cards, or ACH bank transfers. Vendors will appreciate the flexibility as they receive payments via checks or bank transfers, regardless of their preferred payment method.

Optimize your cash flow management without the hassle of juggling multiple payment solutions. This platform not only simplifies transactions but also empowers merchants to maintain control over their finances directly from their existing Shopify interface.

Experience the convenience of managing vendor payments seamlessly, turning complex financial tasks into straightforward actions, all from one user-friendly dashboard.

Shopify Bill Pay

Shopify Bill Pay Xero Bridge by Parex

Xero Bridge by Parex